Sanjeev Sanyal, a member of India's Economic Advisory Council to the Prime Minister (EAC-PM), emphasised that while stagflation in the US isn't inevitable, it's a prospect India must carefully weigh.

Stagflation characterises an economic state marked by a trifecta of high or increasing inflation, slowing economic growth, and steadily high unemployment. It presents a dilemma for monetary policy since actions intended to lower inflation may exacerbate unemployment. Inflation in the United States surged to its highest level in a year, reaching 3.4 per cent from January to March, a notable increase from the 1.8 per cent recorded in the previous quarter.

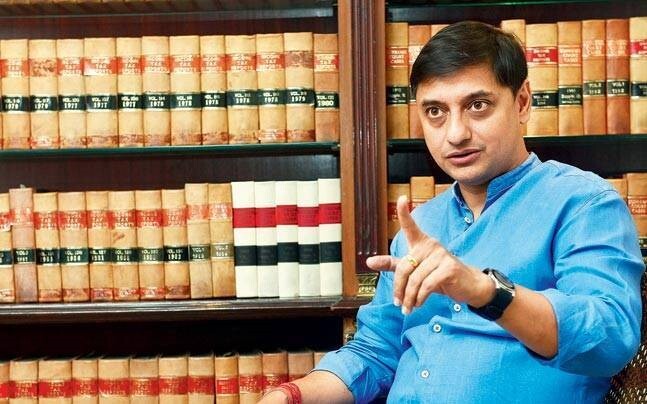

An Indian economist and celebrated historian, Sanjeev Sanyal has played a pivotal role as a member of the Economic Advisory Council to the Prime Minister of India. His significant contributions include crafting six editions of the Economic Survey of India since 2017. Sanyal's professional journey commenced in the mid-nineties within financial markets, where he garnered valuable experience. Over two decades, until 2015, he served as the Global Strategist and Managing Director at Deutsche Bank, establishing himself as a prominent figure in the financial realm.

On April 27, Sanyal stated in a social media post, "The reason for it is simple—the fiscal is too loose, and, in compensation, the monetary is too tight. Until the former is correct, the latter cannot."

"A stagflation situation in the US in 2025 would have global consequences that will complicate macro-management for the rest of us."

The US economy decelerated sharply, growing at a 1.6 per cent annual pace in the last quarter, largely due to high-interest rates. However, consumer spending remained resilient, helping to mitigate the impact. According to recent data from the US Commerce Department, GDP growth slowed from 3.4 per cent in the final three months of 2023 to 1.6 per cent in the January to March quarter.

Consumer spending continued to thrive, with a 2.5 per cent increase, albeit slightly lower than the 3 per cent seen in the preceding two quarters. Notably, Americans' expenditure on services surged by 4 per cent, marking the quickest pace since mid-2021.

A recent Bloomberg report suggests that traders are now anticipating the first rate cut by the US Federal Reserve to be delayed until December. Before the release of recent US data, the consensus among market analysts was that the American Central Bank would initiate interest rate cuts as early as September.

The USA is the largest importer of aluminium and aluminium products. Economic research firm John Dunham and Associates has released its latest survey report, providing fascinating information about the market size and employment of the United States present aluminium industry. The study says the US aluminium industry employs more than 164,000 workers and contributes $92 billion in direct economic output. When indirect economic output is considered, the industry supports nearly 700,000 American jobs and generates $228 billion – nearly 1 per cent of the US GDP. These figures suggest the aluminium industry plays a crucial role in the US economy, providing vast employment opportunities.

The aluminium sectors that create record employment in the US are recycling and semi-finished, especially sheet and plate. However, the closure of primary aluminium smelters was found to have a modest impact on US aluminium industry employment in 2023, declining nominally by -0.1 per cent compared to 2022. AL Circle's industry-focused report, "Global Aluminium Industry Outlook 2024," provides insight into the aluminium industry in the US and its forecast for 2024 and beyond.

As part of his post, Sanyal shared a Bloomberg article titled 'The US economy may be barrelling towards stagflation, an outcome worse than recession'.

The report concluded that the sluggish growth, high inflation, and significant uptick in consumer prices have presented a formidable challenge to the US Federal Reserve's capacity to intervene. The central bank has underscored the necessity for inflation to decelerate before considering any reduction in interest rates.

The Bloomberg report pointed out that stagnant growth and rising prices are crucial elements of stagflation, which can pose a more challenging problem than a recession because these factors limit the US Fed's options.

Responses