SMM statistics showed that China’s aluminium production had a sharp rise in July compared with a year ago. China produced 3.12 million tonnes of aluminium in July, up 16.5% YoY, and 21.42 million tonnes of aluminium during the first seven months of this year, up 20.9% from the same period of 2016. Total annual operational aluminium capacity nationwide stood at 36.74 million tonnes in July, down 872,000 tonnes from June.

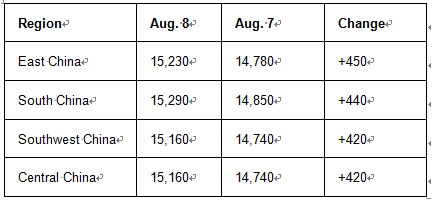

In china’s domestic market, aluminium led the gains in all base metals on Monday’s night trading at SHFE. SHFE 1710 aluminium is expected to rise to RMB 15,350-15,530/t on August 8. Despite the continuous rise in domestic aluminium stock, China Aluminum International Trading Co. (Chalco Trading) hiked aluminium prices it offered across major markets significantly today after yesterday’s big hike.

{alcircleadd}

Now the question is when will the stocks reach a peak and start falling back. Till now, as shown by SMM statistics, aluminium capacity cuts have totalled 2 million tonnes. Considering that August is still the off-season, new capacity will not come into stream on a large scale till September. If things move this way, aluminium stocks should reach a peak in the first half of September. So, according to SMM analysis, there is a good chance for the Chinese aluminium market to destock slightly during fourth quarter of 2017.

China's Shandong province plans to cut Aluminum and Alumina capacity from November 2017 to March 2018, and State Development and Investment Corporation (SDIC) projects this move would increase the risk of prices volatility and raise aluminium prices.

{googleAdsense}

"Market players are waiting for news on an estimated 1 million mt/year of aluminium smelting capacity in Inner Mongolia that has breached state rules. This, plus the government's circulars [on outdated aluminium capacity shutdown and output cuts] has resulted in speculative activity," SDIC quoted.

Responses