As per the data shown by Aluminium Association of Canada, Canada’s primary aluminium industry is the fourth largest in the world with an annual production of 3.2 million tonnes of primary aluminium, using the lowest carbon footprint. Alcoa, Aluminerie Alouette and Rio Tinto operate 10 plants in Canada (9 plants in Quebec and 1 in British Columbia). The industry supports more than 8,000 jobs in Canada generating over 5.5 billion US$ in annual deliveries.

{newsStudioGallery}

{alcircleadd}The country imports the largest part of its alumina to feed its smelters. Rio Tinto owned Vaudreuil refinery, Jonquiere and Quebec refineries produce about 1.56 million tonnes of alumina and the rest they import from several parts of the world.

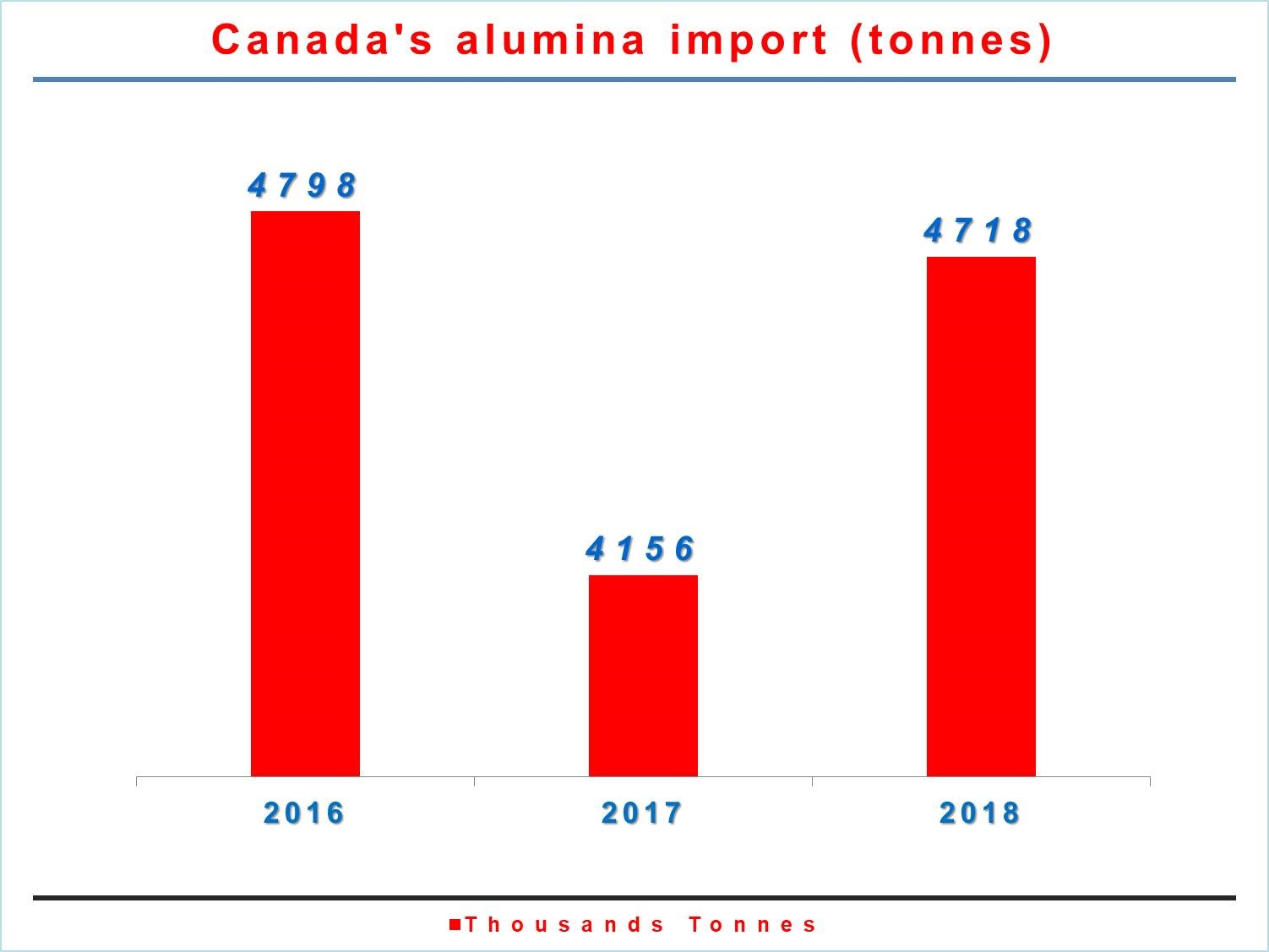

According to the global export-import data, Canada is forecast to import 4.7 million tonnes in 2018, compared to the estimated alumina import volume of 4.1 million tonnes in 2017. In 2016 also, Canada had imported 4.7 million tonnes of alumina. This shows, the volume was 12 per cent down in 2017 from both 2016 and 2018.

Canada’s alumina import cost is expected to be at US$ 1476 million, as shown by the export-import data. This indicates that although the expected amount of alumina import to Canada in 2018 is similar to that of 2016, the value is forecast to see a growth. This could be because of the global alumina price growth as well as a hike in its demand. Many smelters around the world are planning to recommence their productions particularly in the United States, namely Century Aluminium and 7 Metals.

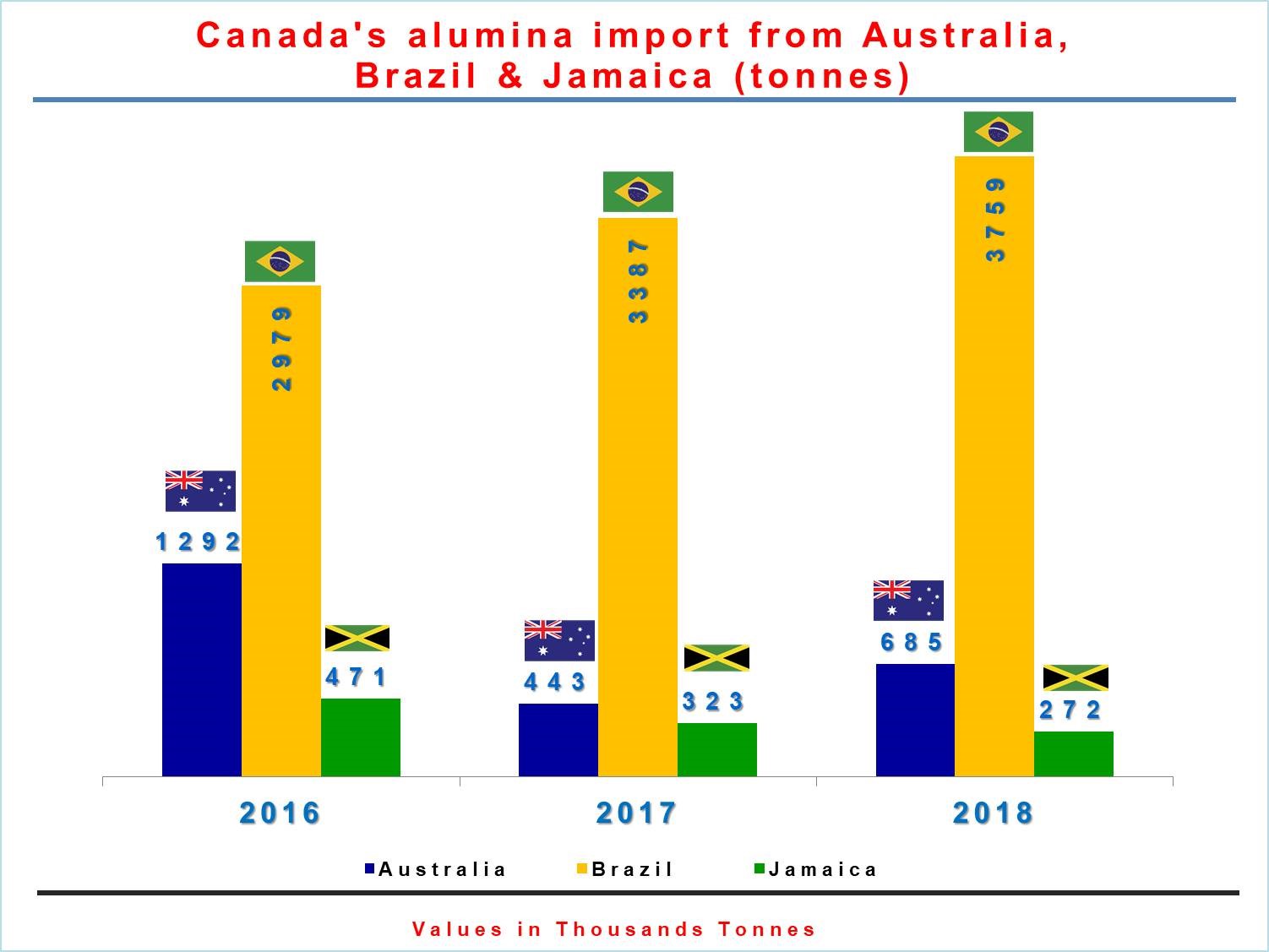

Like the two subsequent years, Canada is predicted to import a maximum amount of alumina from Brazil, followed by Australia and Jamaica. In 2018, the imported volume from Brazil is forecast to be at 3.7 million tonnes and from Australia and Jamaica 0.6 million tonnes and 0.2 million tonnes. For more details, refer to the graph given below.

Responses