Global metals supply chains under geopolitical strain, China crucial in green tech: BofA report

In a recent report, Bank of America (BofA) underscored the profound impact of geopolitical dynamics on global metals supply chains, spotlighting China's pivotal role in green technology industries. The report highlights China's overwhelming dominance in producing electric vehicles (EVs), batteries, and solar panels, posing a significant competitive hurdle for companies outside its borders.

This monopolistic position has not gone unnoticed in developed markets (DMs), where there is a growing sense of urgency to reassess and diversify their supply chains. The geopolitical risks associated with heavy reliance on Chinese manufacturing capabilities have become a focal point of concern, prompting these markets to explore alternative strategies to mitigate potential disruptions and ensure the stability of their green technology sectors.

The report by one of the world's leading financial institutions shows that global metals consumption is poised for significant shifts in the coming years. Firstly, the move towards re-shoring is set to boost metal consumption in developed markets (DMs) through heightened investment in fixed assets and an uptick in manufacturing activities.

Secondly, China's recent pullback on green technology investments and rising trade barriers may dampen its metals demand. Lastly, technological innovations in DMs are expected to alter the current materials mix, potentially leading to the use of different metals.

It's important to note that China is the world's largest aluminium producer, accounting for about 60 per cent of global production. Additionally, China ranks third in copper production.

While the Bank of America report maintains an optimistic outlook for metals like copper and aluminium, driven by the ongoing energy transition, it also underscores several risks. These include the potential fallout from an escalating global trade war, which could impede economic growth and restrain metals demand. This balanced view prepares stakeholders for potential challenges and benefits in the metals industry.

Additionally, regional metal prices could diverge significantly due to increasing tariffs. Enhanced investment in innovation also results in greater efficiency and substitution effects, potentially unexpectedly altering price trends for certain metals.

The report highlights a concerted effort by DMs to lessen dependence on China's metals supply chains, reminiscent of Europe's energy security crisis stemming from reliance on Russia. The structural overcapacity in China's industries poses a threat to major employers in the US and Europe. Consequently, bipartisan backing in both regions favours imposing trade barriers, such as anti-dumping inquiries into sectors like EVs, solar, and wind. BofA suggests that while protectionism isn't the ideal fix, innovation may reshape the mining sector's competitive dynamics, potentially leading to new victors and vanquished entities.

According to AL Circle’s industry-focused report, “Global Aluminium Industry Outlook 2024”, it has been revealed that the Metals and Minerals Price Index of the World Bank witnessed a marginal decrease of 0.13 per cent in the fourth quarter of 2023, marking a continuation of the consistent declines observed since early 2022. This downturn is attributed to a deceleration in economic activity in significant global economies, leading to a subdued demand environment alongside ongoing recoveries in the supply of certain base metals.

Projections indicate a 5 per cent decline in metal prices for 2024, following a nearly 10 per cent decrease in 2023 on a year-on-year basis. Prices are anticipated to stabilise in 2025 on a year-on-year basis. Noteworthy risks to these forecasts encompass the possibility of weaker-than-anticipated demand from both China and advanced economies, as well as potential disruptions to production. Additionally, an escalation of the ongoing conflict in the Middle East could introduce uncertainties in trade, thereby impacting prices.

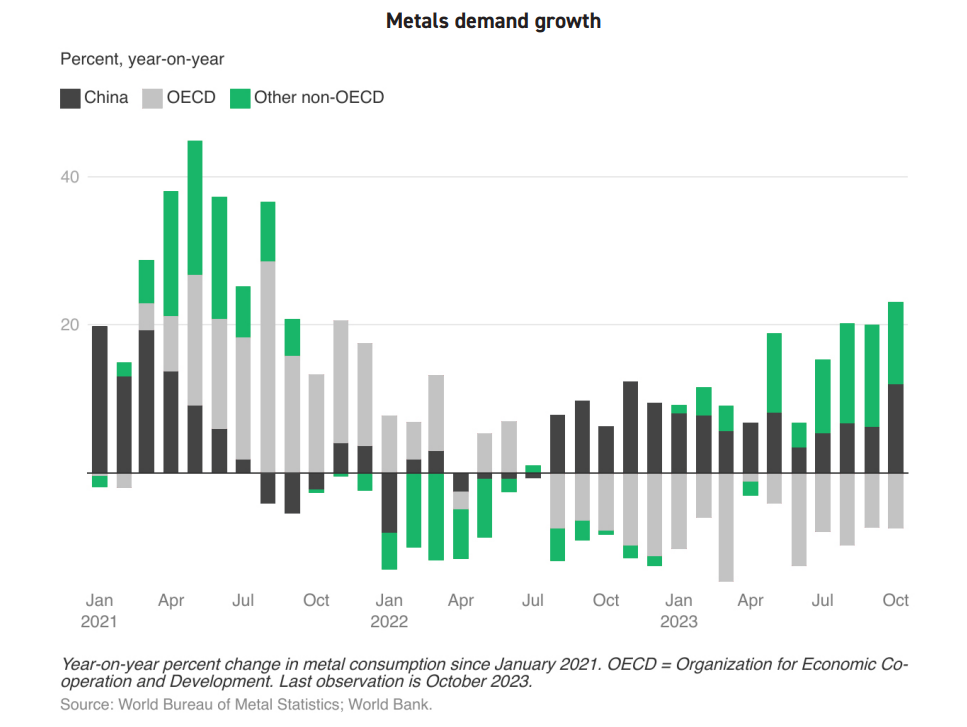

Metal demand experienced a modest growth of 0.6 per cent in the third quarter of 2023 compared to the previous quarter, reflecting the subdued state of global manufacturing activity. This pattern correlates with the consistent contraction observed in the global manufacturing Purchasing Managers Index throughout the year. The tightening of monetary policies in advanced economies exerted pressure on consumer demand for durable goods with high metal intensity. Despite a downturn in the property sector, China’s metal demand was sustained by robust demand in infrastructure and manufacturing, the ongoing energy transition, and positive expectations surrounding policy stimuli aimed at bolstering economic activity.

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)

.jpg/0/0)