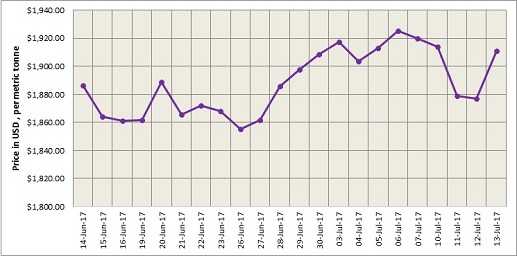

LME aluminium jumps nearly 2% on China output cut talks; inventories lowest since 2008

China is literally in the driver’s seat when it comes to aluminium. The giant accounting for the more than 50 per cent of the world’s total production is controlling the dynamics of the entire aluminium market, to say the least. This was once again proven correct when yesterday the lightmetal traded on London Metal Exchange rose nearly 2 per cent- the biggest one-day increase in last three months, as the news of China curbing aluminium smelter capacity sparked a midday rally. LME aluminium hit a peak of US$1,943 per tonne.

After night trading on Thursday, July 13, LME aluminium settled at US$1,911 per tonne, still 1.8 per cent up from its previous day’s close of US$1,877 per tonne.

{alcircleadd}According to Reuters’ technical analysis, LME aluminium looks neutral in a range of US$1,917-$1,939 per tonne, and an escape could suggest a direction. Shanghai Metals Market predicts that LME aluminium will continue to hover at highs and range at US$1,918-1,940 per tonne on Friday, July 14.

As on July 13, LME official cash buyer aluminium price stands at US$1,910.50 per tonne, cash seller & settlement aluminium price is US$1,911 per tonne, 3M buyer price is US$1,928 per tonne, 3M seller price is US$1,929 per tonne, Dec1 buyer price is US$1,960 per tonne, and Dec1 seller price is US$1,965 per tonne. The current LME official Opening Stock of aluminium is estimated at 1386100 tonnes, total Live Warrant is 1063425 tonnes, and Cancelled Warrant is 322675 tonnes.

LME aluminium premiums remain unchanged across major markets worldwide. As on July 12, LME aluminium premium for the US stands at US$180, LME Aluminium West-Europe Premium stands at US$80, LME Aluminium East-Asia Premium is US$105, and LME Aluminium South-East Asia Premium is US$15 (per tonne).

{googleAdsense}

The benchmark aluminium price at Shanghai Metal Exchange (SME) has risen higher at US$2,092 per tonne on Friday, July 14, up 1.01 per cent from Thursday’s benchmark price of US$2,071 per tonne.

At Shanghai Futures Exchange (SHFE), the most active aluminium future contract SHFE 1709 aluminium opened at RMB 14,225 per tonne on Thursday, July 13, and then rose on the news of Weiqiao Group cutting capacity. Later the contract fell and ended at RMB 14,320 per tonne. SMM predicts that SHFE 1709 aluminium will fluctuate between RMB 14,350-14,550 per tonne on Friday, July 14.

Spot aluminium in China domestic market is expected to trade at discounts of RMB 70-30 per tonne on Friday.

The market focus will be on eurozone’s balance sheet in May, US’s annual CPI in June, monthly retail sales and industrial production on Friday, SMM said.

This news is also available on our App 'AlCircle News' Android | iOS