您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Aluminium Import Duties in Mexico: Previewing Possible Upcoming Changes: Mexico’s Chamber of Deputies has moved forward with reforms to its General Import and Export Tax Law, setting the stage for significant changes to aluminium import duties. The Commission on Economy, Trade and Competitiveness approved the revised draft in early December, lowering tariffs on hundreds of products while introducing new duties that could reshape trade flows and impact key industrial sectors. As of 11 December 2025, Beijing Time (10 December 2025 Mexico City Time), the Mexican Senate has also approved these changes to the import tariff law, effectively locking in the new tariff schedule for implementation from 2026.

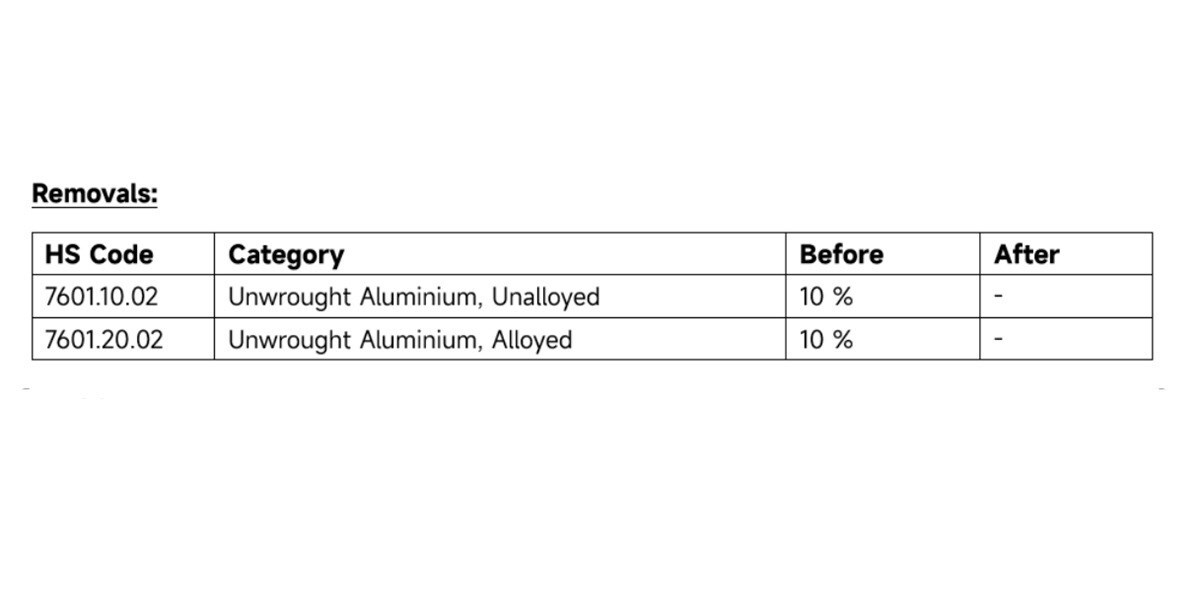

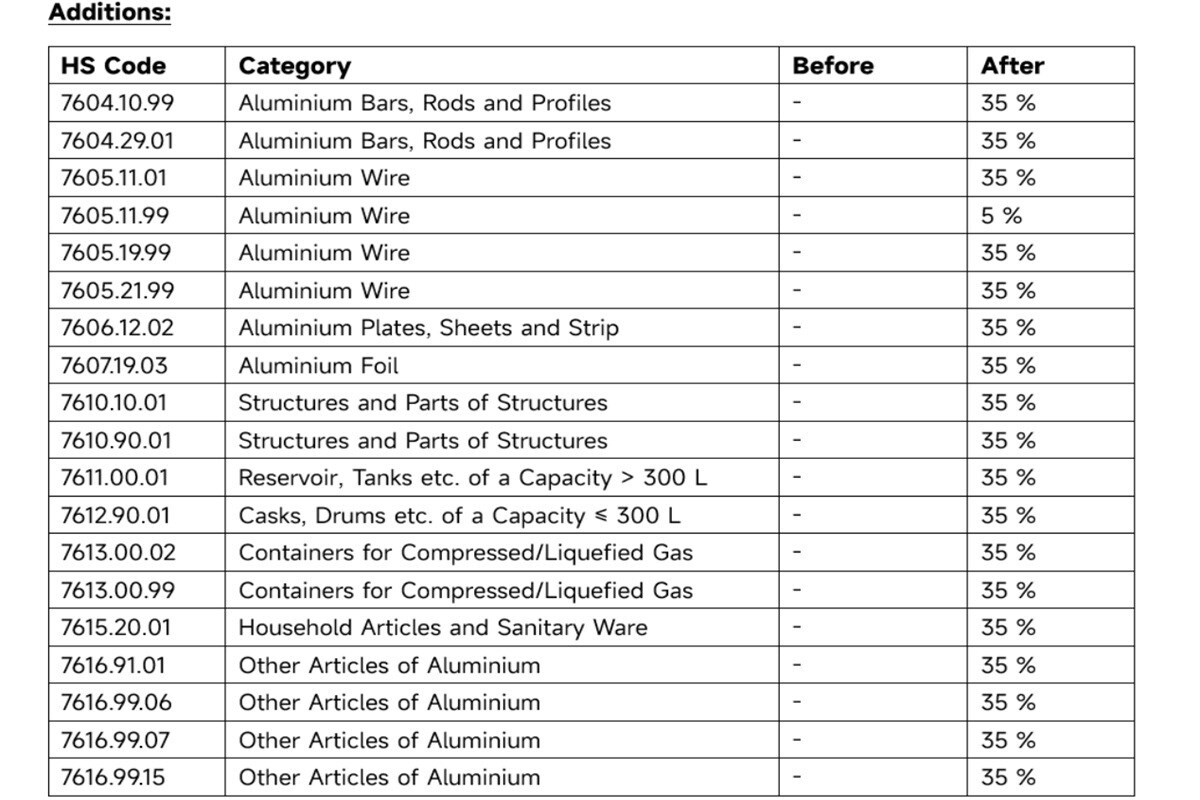

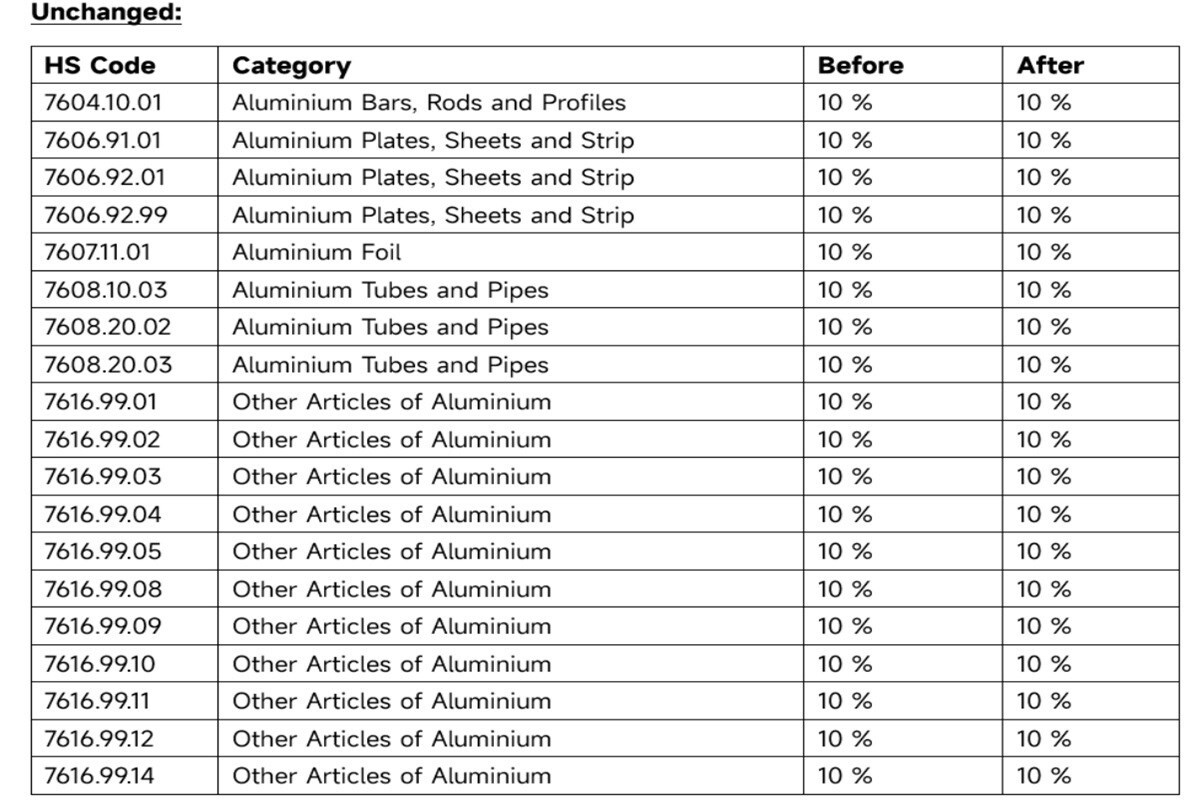

{alcircleadd}Aluminium, as a key sector and trade product, saw important changes to its import tariff schedules and listings; many related HS codes are set to face revised duties under Mexico’s latest tariff reform. In total, for aluminium-related HS codes, 2 were removed, 19 were added and 19 codes remained:

Implications

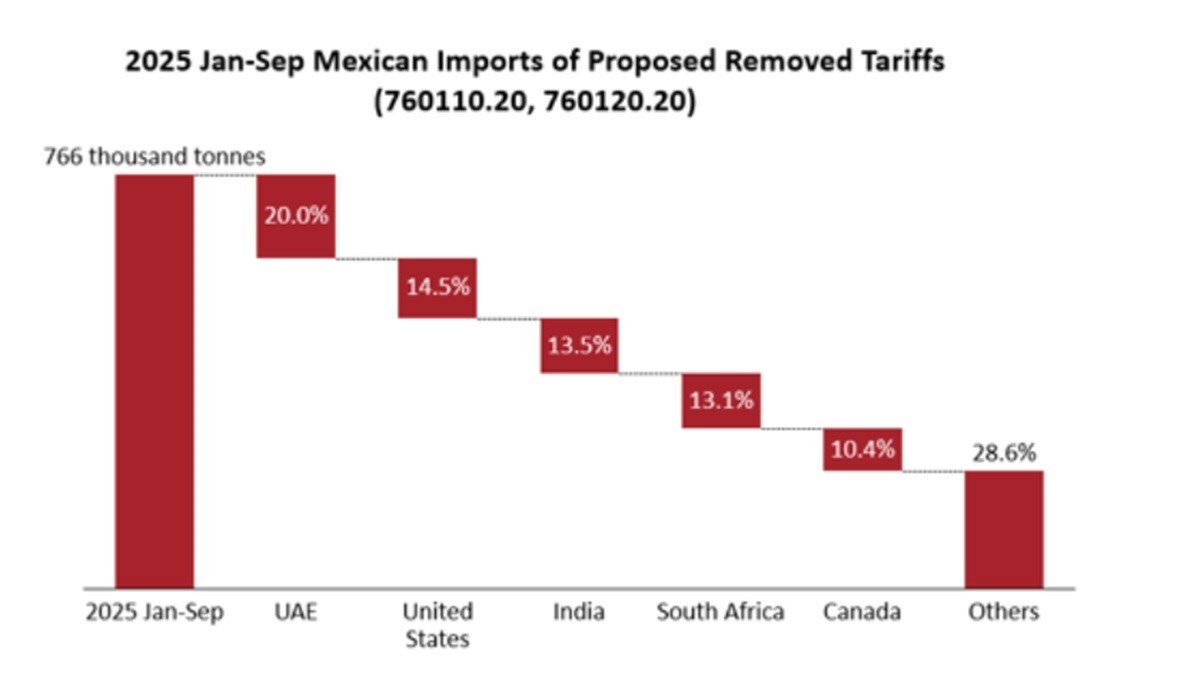

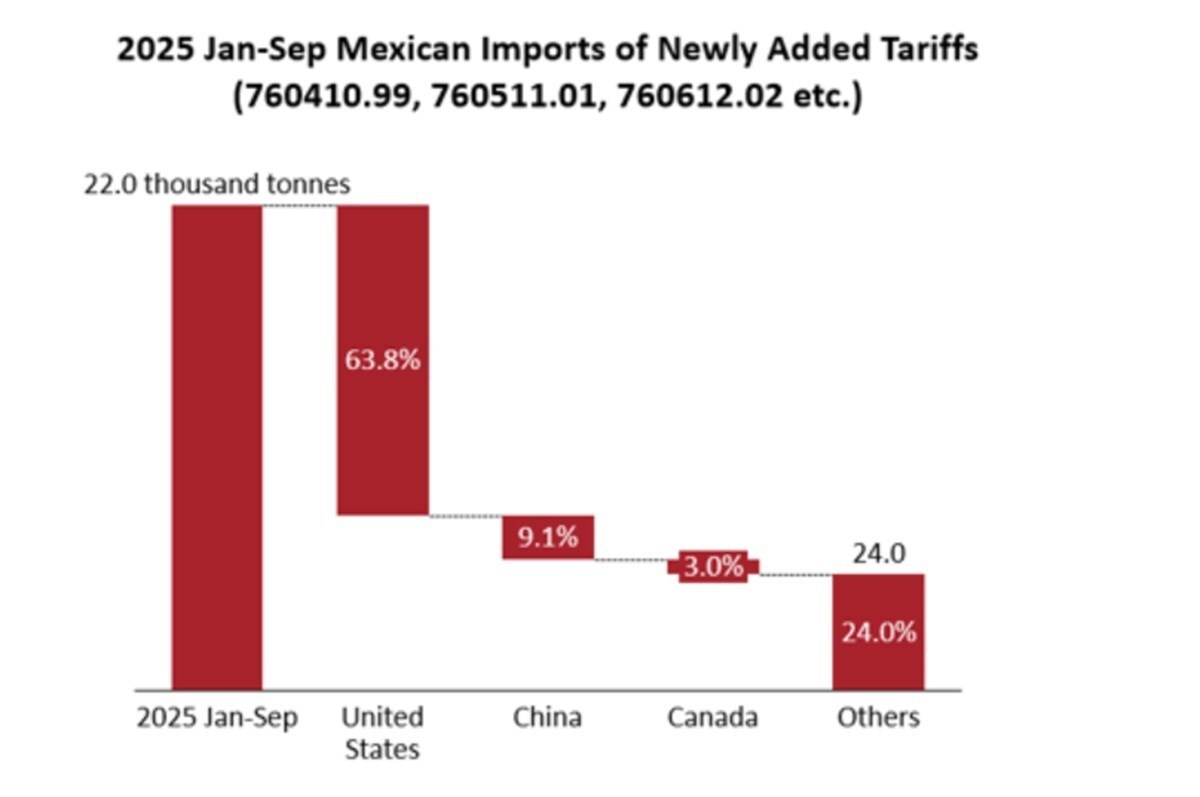

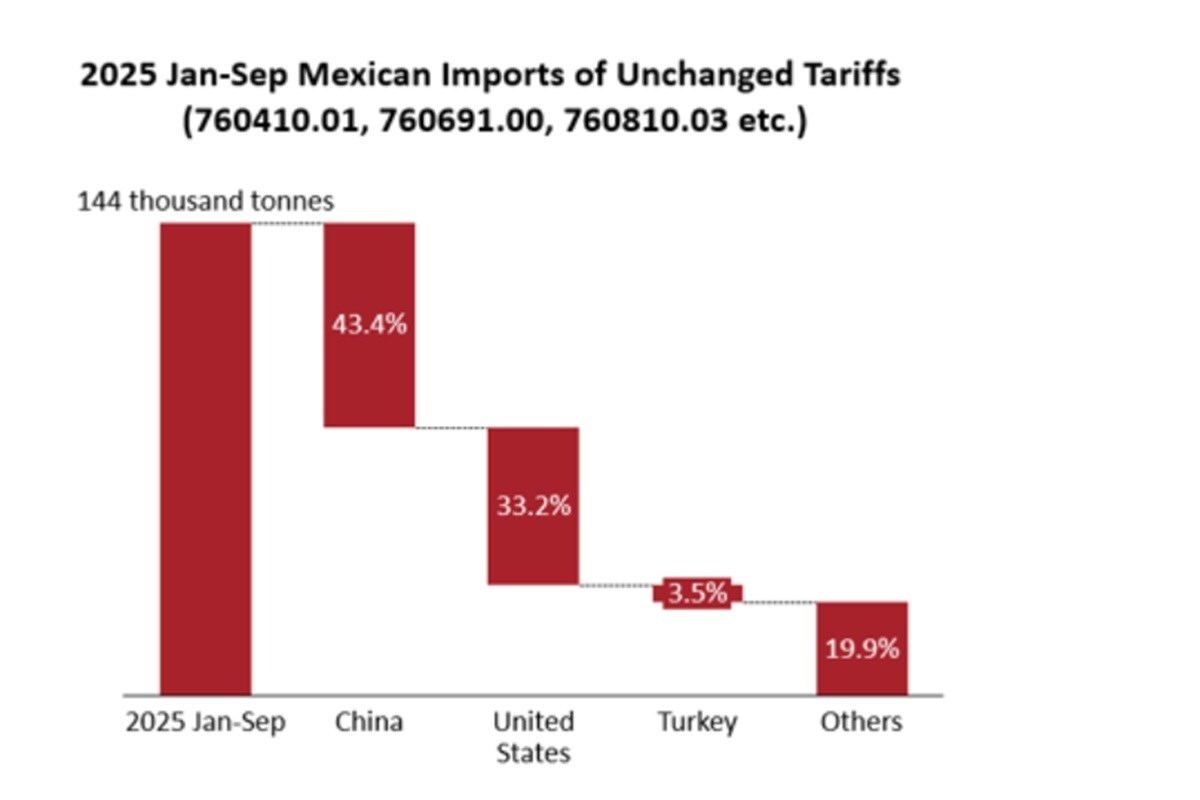

The new tariff regime unequally affects different partner countries of Mexico in the aluminium trade:

These tariff adjustments mark a turning point in Mexico’s aluminium trade policy. By removing duties on primary aluminium while imposing new levies on downstream products, the government is signalling support for domestic manufacturing while reshaping import dynamics with major partners such as China, the United States, and Turkey. As final approval by the Senate has been passed by the11th of December 2025, industry stakeholders should prepare for implementation and possible implications by 2026, especially for traders and manufacturers based in China and the USA.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses