Recap 2016: How Aluminium endorsed sustainable and functional packaging

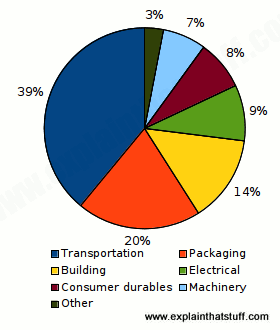

Packaging in today’s world is more about functionality and sustainability and goes far beyond just aesthetics. Aluminium because of its low density, malleability and recyclability, contributes functionally to the fabrication of packaging units that are not only safe for storing perishables but are also lightweight and sustainable. Aluminium packaging provides optimal protection to the packaged products due to aluminium’s non-reactive properties and cosmetically it renders a premium appeal to any packaging which indirectly helps in effective branding. Globally, construction and transport account for 50 per cent of aluminium consumption and packaging contribute about 17per cent of it. However in developed countries like USA, packaging contributes 20 per cent of aluminium consumption.

Packaging applications require either thin or rigid aluminium foils. The origin of aluminium foil can be traced back to early 1900s in the U.S. when they were used to wrap candies. The uses of foil have grown manifold over the century to cover everything, the most popular being food and medicine packaging and beverage cans and aerosol cans. In our recap 2016 coverage, we take a look back at the top packaging news from our end user vertical.

Aluminium can: How it changed beverage and spray packaging?

Aluminum cans are the most sustainable beverage package because of the higher recycling rate and more recycled content than competing package types. According to Aluminum Association, they are by far the most recycled beverage package in the United States with a 13 to 24 point recycling rate advantage against glass and plastic.

1.European beverage packaging group, Ardagh Metal Beverage USA Inc. buys Rexam Beverage Can facility in Winston-Salem in order to expand their can market in USA.

2.In July 2016, Ball Corp. finalized its $6.1 billion acquisition of British competitor Rexam, making the Broomfield-based company the largest (aluminium and tinplate) beverage can maker in the world. The combined company accounts for 60 per cent of beverage can supply in North America, 69 per cent in Europe and 74 per cent in Brazil, with 75 manufacturing facilities across five continents, 18,700 workers and an estimated $11 billion in net sales for 2015.

3.Aluminium beverage cans labelled with UPM Raflatac's VANISHTM film is fit for recycling, confirmed Novelis. The world's largest recycler of aluminium cans said the thin 23-micron VANISHTM label is ‘sufficiently light’ in order not to affect the quality of the secondary aluminium produced through recycling.

4.America has experienced a huge craft beer boom over the past decade. The Brewers Association, of America has set a target of 20% market share for craft beer by 2020. 2016 is marked by increased can packaging for craft beer. A microbrewery can make considerable profits only by packaging its beer in cans and selling it for outside consumption. Analysts have predicted craft beer boom to induce aluminium can boom in near term. A number of breweries like Westons and wineries like Indiana decided to package their alcoholic beverage in aluminium cans.

5.Showa Aluminium Can Corporation (SAC), a wholly owned consolidated subsidiary of Showa Denko (SDK) headquartered in Tokyo, will start to produce aluminium sleek cans for beverages in Vietnam from December 2016.

Aluminium food & medicine packaging: safe and convenient

1.Consumption of aluminium foils is rising steadily all across the globe. According to Technavio's latest report, the global aluminium foil packaging market will grow at a CAGR of 3.69 per cent by volume during the period 2016-2020. The report identifies increasing demand from packaged food industry as the key driver for the aluminium foils market growth. The underlying factors supporting the growth are changing lifestyle of the modern consumers who look for hygiene, convenience, aesthetics, and sustainability in their daily consumables.

2.Pioneering development work at Ardagh Group’s specialist aluminium can plant in Cuxhaven; north Germany has produced the world’s lightest aluminium seafood can in June 2016.

3.Constantia Flexibles has completed its acquisition of Vietnamese pharmaceutical packaging manufacturer Oai Hung, strengthening its presence in Asia. Headquartered in Ho Chi Minh City, Oai Hung produces aluminium blister foil and rigid film for the growing local pharmaceutical market.

{googleAdsense}

4.Multivac, the leading provider of packaging solutions for food, medical and pharmaceutical products as well as industrial and consumer goods, worldwide, announced the expansion of its BASELINE series with the introduction of Double Chamber Machine P 650. The new machine would be suitable for use in craft firms in the food industry for aluminium packaging of bulky or long foodstuffs.

5.The UK's leading aluminium foil tray manufacturers, i2r Packaging Solutions launched a range of tulip muffin aluminium foil wraps and greaseproof papers to expand their bakery offering. This would put the firm as the only UK manufacturer to provide a one-stop-shop for both aluminium foil containers and FSC accredited tulip paper products for baking industry.

Market Synopsis

1.According to figures released by EAFA, the European Aluminium Foil Association first quarter results for aluminium foil deliveries from European suppliers showed positive growth in domestic demand, after a sustained period of mixed or declining results. Exports, however, remain under pressure due to strong competition from non-European producers. But, in third quarter, deliveries of aluminium foil from European rollers fell by 1.6%, putting year-on-year targets under pressure. Total deliveries for the first nine months of 2016 stand at 655,800 tonnes, down slightly, by 0.4%. The results are affected by cheap export and destocking in the domestic market.

2.The U.S. is one of the biggest markets of global aluminium foils. According to the Aluminum Association, the aluminium foil market in the North American country is currently valued at $5 billion, and about 36% of the total demand is met through imports, up from only 16% in 2007. As an interesting observation, net U.S. exports of aluminium sheets, plates, and foil displayed a generally upward trend from 2007 to 2013. However, over the last two years, this growth has slowed down significantly. In fact, exports of rolled aluminium products including aluminium foil have fallen by almost three times larger in value, resulting in a huge trade surplus of $511 million in 2015.

3.India along with other South-east Asian countries, on the other side, have projected great growth prospects in the aluminium foils market, though their share in the availability and consumption of aluminium foils is still way behind the per capita consumption rates of the developed world.

More highlights

1.Each year, EAFA, the European Aluminium Foil Association organizes the Alufoil Trophy competition to offers the opportunity for companies to showcase the very best and latest aluminium foil and closure applications and ideas. The year 2016 is no exception with 65 entries across the five major categories producing 10 outstanding winners, plus an Overall Excellence winner, which scored extremely high marks in all categories.

2.The average recycling rate for aluminium closures in Europe has increased to more than 50%, according to figures released recently by the “Aluminium Closures – Turn 360°” campaign by the European Aluminium Foil Association. Aluminium closures are used for wine, spirits, water and olive oil. Thanks to modern processes the aluminium is easily extracted and recycled, from both material streams.

The use of aluminium in packaging is growing and it will grow more in the coming times due to the quick growth of GDP and consumer economy in the developing countries. Currently, Asian manufacturers are growing fast in the foil market due to low production cost and the ability to produce quality products at a low price. The Chinese export is not only cheaper; they are also of good quality and can be easily customised to the client’s requirement. The west should capitalize on the growing end user demand and focus on producing foils at a competitive price. The year 2017 would open up more opportunities in the packaging sector for aluminium.

This news is also available on our App 'AlCircle News' Android | iOS